An online lender claiming to offer an easy solution to short-term credit needs had its license revoked by the California Department of Financial Protection and Innovation (DFPI).

An examination by DFPI revealed that CreditNinja charged excessive fees and interest rates that violated the state’s rate cap.

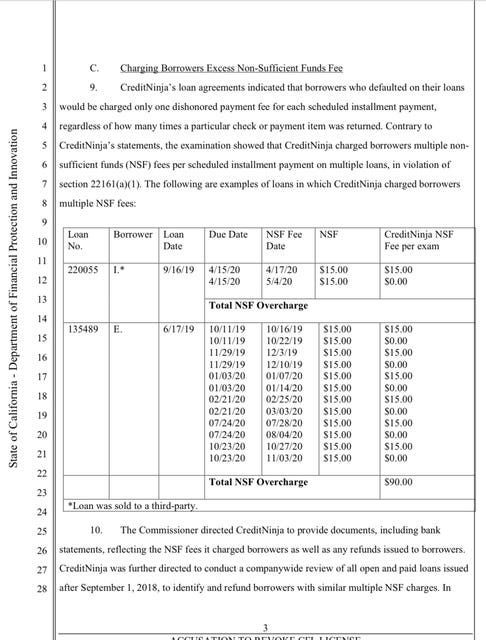

According to DFPI's examination, CreditNinja charged interest rates on some loans in excess of 200% APR, despite a rate cap of 36%. The company also charged excessive fees, including charging multiple insufficient funds fees on the same denied payments.

While CreditNinja’s website says:

We are a superior online lender offering more affordable personal loans, for borrowers with low credit scores. Our quick and easy loan process allows you to get the cash you need, at ninja speed. If you’re currently experiencing a financial emergency, CreditNinja is here to help.

The reality is CreditNinja only helped themselves to customer cash by breaking the law. They charged multiple NSF fees on the same declined payment, for example. And charged 200% or more for some loans, in clear violation of California law.

CreditNinja also says:

CreditNinja’s goal has been—and always will be—to help borrowers who are experiencing difficult financial situations.

But, these pages from California’s revocation tell a different story:

Enforcement actions like this one are what consumers will need to rely on now that Elon Musk has crippled the federal Consumer Financial Protection Bureau (CFPB).

Luckily, states are heeding the call - like in New York and Tennessee:

New York’s Attorney General is pushing a comprehensive update of that state’s consumer protection laws, while a TN lawmaker is seeking to help reduce the burden of medical debt for the people of her state.

Advocate Andy now has more than 200 subscribers - thank you! If you aren’t yet a subscriber, consider becoming a free or paid subscriber today. Either way, take a moment to also like and share this post. Together, we can hold the robber barons at bay - a task more important now than ever.

While state enforcement may be uneven at this point, you can take action in your state if you have a consumer protection concern.

First, start with your state’s Attorney General.

Attorneys General typically have consumer protection divisions and can apply relevant state laws to your situation. Sometimes, if an AG asks, a company will answer.

Second, let your Member of Congress know. One, they may be able to assist with a resolution. But also, it is important for Congress to know their constituents value the work formerly performed by CFPB. Congress can rescue the consumer champion from the DOGE Death Star . . . if they want to.