Can Banks Run Payday Lenders Out of Business?

Do you really need the Dave app or a visit to a sketchy payday loan store?

The payday lending industry capitalizes on the need to access short-term cash quickly — usually for an emergency or unplanned expense. Most major banks don’t offer these types of products — loans for $500 or less — because the cost to issue and service these loans outweighs the revenue.

Troubling Data on the Financial Health of Americans

One survey suggests that more than 1/3 of Americans have signed up for some type of payday lending app — like Dave.

These app-based lenders — Dave, MoneyLion, SoLo Funds — offer convenience that often comes at a high cost. That is, interest rates well into the triple digits.

Then, of course, there are the traditional storefront payday lenders — companies like SpeedyCash, Check into Cash, Advance America, and others.

They offer loans usually up to $500 — but with interest rates well into the triple digits.

Now, though, some banks are getting into the small-dollar loan space. These loans are offered to current customers of the bank and are based on a customer’s banking history — making underwriting fairly easy. Plus, since the loans are from the bank where a customer maintains their account, the bank has direct access to repayment.

Pew provides more information on how these loans work — and the benefits in terms of costs.

Pew notes:

Although banks use different criteria to determine eligibility for small-dollar loans, the four major ones offering them — Bank of America, Huntington, U.S. Bank, and Wells Fargo — primarily base their qualifications on the customer’s account history with them; for example, whether the potential borrower has been a customer for a given number of months, uses the checking account or debit card regularly, or has direct deposit for paychecks. All 12 million Americans who use payday loans annually have a checking account and an income because those are the two requirements for obtaining a payday loan.

The benefits are clear — customers get a longer time to repay a short-term loan and pay significantly less for the money. This prevents the cycle of debt that is common with payday loans or payday advance apps.

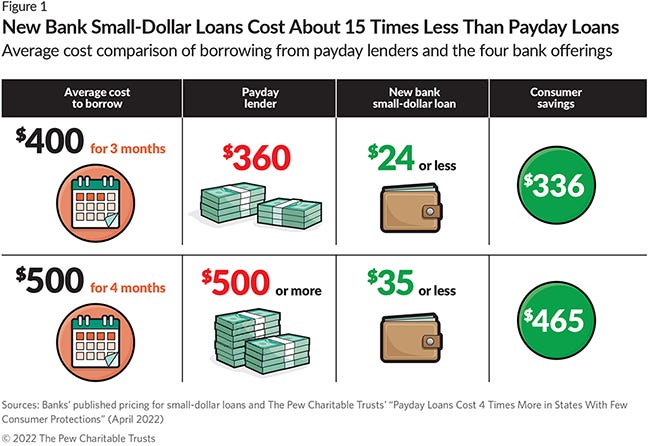

The large banks offering small-dollar loans are charging prices that are at least 15 times lower than average payday lenders. The loans are repayable over three to four months, which is in line with consumers’ views of the time necessary to repay small loans. Compared with typical payday loans, which keep borrowers indebted for five months of the year on average, consumers can save hundreds of dollars using the banks’ loans instead.

While these changes only reach 18% of banked consumers, it is a big step in the right direction.

Before you download an app or visit a payday loan store, check with your bank to see what small-dollar loan options they may offer.

It seems likely more banks will join in and offer their customers affordable, small-dollar loan options in order to keep their business.

Combine this with improvements in how overdraft fees are handled, and consumer banking could become a better experience — one that meets the needs of a larger segment of wage earners.