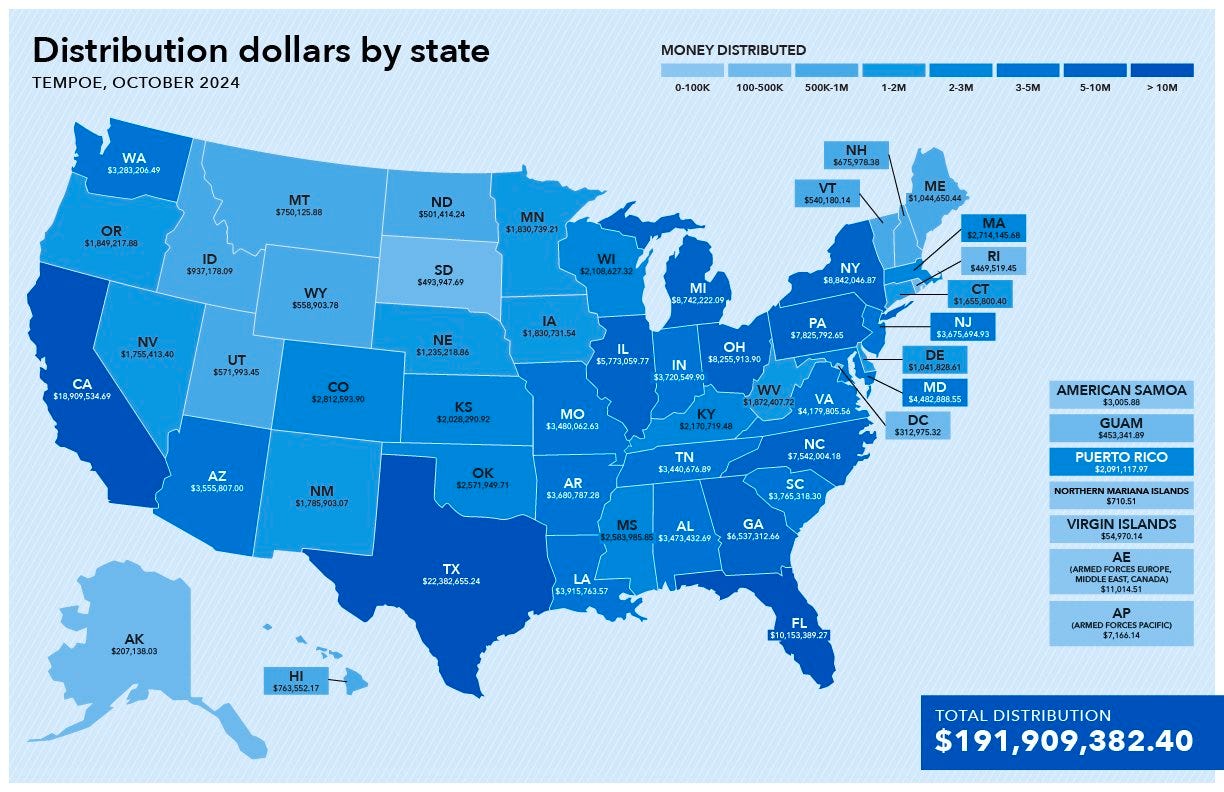

Kmart, Sears Customers to Share $191 Million in Settlement Payments

Financing company offered deceptive and illegal contracts

As of September of this year, there were nine Sears stores left in the United States. The last full-scale Kmart in the U.S. closed earlier this month.

But, in the waning days of these once-proud retail giants, the companies offered customers financing schemes that included some pretty nasty surprises.

I wrote before about the surprise debt customers discovered a few months into popular financing schemes offered at Sears and Kmart by a nonbank lender known as Tempoe.

250,000 customers paid Tempoe $191 million as a result of deceptive and illegal financing contracts.

The contracts were “rent-to-own” or “lease-purchase” agreements. If a customer wanted to finance their purchase at Kmart or Sears, Tempoe would buy the product and pay the store in full.

The customer would then pay Tempoe a small deposit and leave the store with the item(s). The surprise came five months later. After making a series of small payments, Tempoe would demand a large payment to complete the purchase - often at a cost many times the actual value of the product.

The customer had two options: Return the product and receive nothing OR make the payment.

These terms were NOT disclosed to customers. Tempoe also refused to accept returns on any product with a value less than $300, thus forcing customers to continue making monthly payments, often for terms up to 36 months.

Now, there’s some good news.

The Consumer Financial Protection Bureau (CFPB) will pay the 250,000 defrauded customers a share of a $191 million settlement pool.

Customers across the country will receive payments as a result of the enforcement action:

Map provided by CFPB indicating funds paid out from Tempoe settlement