Banking fraud is a big deal.

Whether it is someone or an entity improperly accessing your account, improper charges from your bank, or accounts opened in your name without consent - the impact can be devastating.

Getting things back in order after the fact can be frustrating and time-consuming.

Unfortunately, some of the biggest perpetrators of banking fraud are the banks themselves.

Yes, you agree to bank somewhere, park your money there, and then the bank uses your personal financial information to boost its bottom line.

Big Banks Being Bad

A recent example of this can be found at Bank of America.

The banking giant got caught filing false mortgage application data with federal regulators.

“Bank of America violated a federal law that thousands of mortgage lenders have routinely followed for decades,” said CFPB Director Rohit Chopra. “It is illegal to report false information to federal regulators, and we will be taking additional steps to ensure that Bank of America stops breaking the law.”

The penalty?

A paltry $12 million.

To a bank with assets in the trillions, this is small potatoes.

In fact, by comparison to previous fines issued to BofA, this is chump change.

“Bank of America wrongfully withheld credit card rewards, double-dipped on fees, and opened accounts without consent,” said CFPB Director Rohit Chopra. “These practices are illegal and undermine customer trust. The CFPB will be putting an end to these practices across the banking system.”

For that offense, the bank was fined $250 million, including $100 million in direct payments to wronged consumers.

Bank of America has been a repeat offender, paying more than $1 billion in fines for malfeasance since 2014.

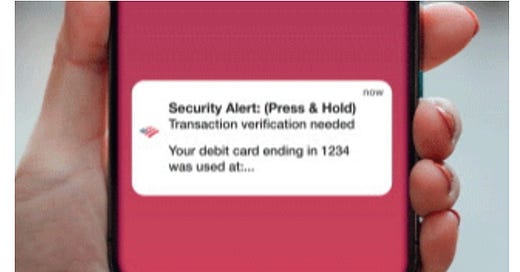

So, while BofA is sending out tips to help customers avoid fraud, it seems one of the best ways to avoid banking fraud is to NOT bank at Bank of America.

Oh, and avoiding banking fraud might also mean avoiding banking at Wells Fargo:

Now if only I could persuade the many people I know who use either of these decrepit businesses. 🤔