Tennessee: A National Leader in Debt

Medical debt, student loans drive debt burden in the Volunteer State

A new report from ThinkTennessee indicates many Tennesseans face a crushing debt burden.

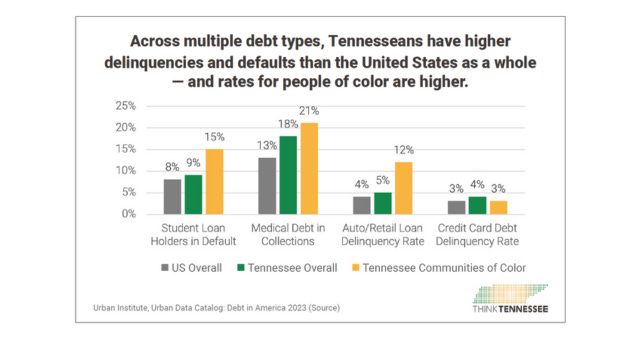

People in Tennessee hold more distressed debt than the national average. This includes medical debt - which Tennesseans hold at a significantly higher rate than the national average.

The average debt load for a Tennessean is $50,000.

Medicaid expansion is one way to address medical debt. Federal dollars would cover almost all of the cost and working Tennesseans could access affordable healthcare.

Mississippi moved last week to expand Medicaid with federal funds, likely leaving Tennessee as one of only a handful of states not taking advantage of this program.

An approach like the one taken by Toledo could also help - buying medical debt and discharging it.

Tennessee has billions of dollars in surplus funds in various accounts. The state could set up a fund to buy medical debt to provide immediate relief. Doing so would provide stability to families and likely boost local economies. Expanding Medicaid would help ensure medical debt doesn’t get to this level again.

Another action Tennessee could take is capping payday loan rates at 36%.

Tennessee is the birthplace of the payday loan and currently allows interest rates exceeding 400%.

Finally, removing the tax on groceries would allow Tennesseans to maximize their spending power on necessities - especially in the current inflationary climate.

While the state allowed a three-month grocery tax holiday in 2023, Gov. Lee says there are no plans to offer a similar tax break this year. Instead, the state is pursuing a $1.6 billion corporate tax giveaway.

MORE CONSUMER NEWS

World Acceptance Comes Under Scrutiny