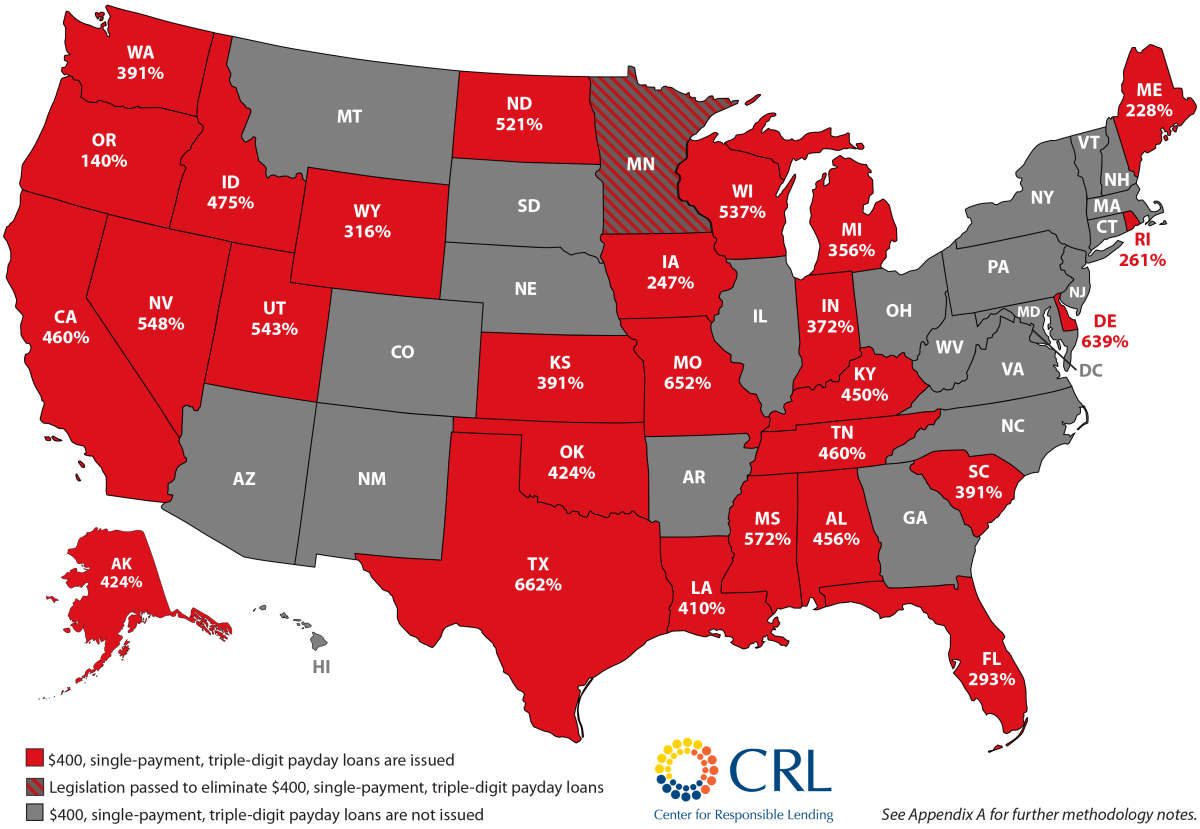

The Center for Responsible Lending has published a map of payday loan interest rates.

Despite efforts to rein-in payday predators, a number of states still allow triple digit interest rates on short term loans - leading to a cycle of debt that can be difficult to escape.

As CRL notes:

Researchers at the Consumer Financial Protection Bureau (CFPB) found that payday lenders collect 75% of their fees from borrowers with more than 10 loans per year, demonstrating that their business model is dependent on this long-term cycle of debt.

Here’s the map - would love to know about efforts in the states to curb payday lending: